Our Process

Third Stream Research distinguishes itself from traditional sell-side analysts with an approach that is a hybrid of buy- and sell-side research. We prioritize a company’s unique story (qualitative analysis of innovation, intangibles, narratives), applying fundamentals and market data and trends in support of the thesis and central themes. This process is highly effective for technology-intensive emerging growth companies.

Stories matter more at the earlier stages of a business, while numbers speak more loudly as companies mature. Analysis for Third Stream Research’s universe of coverage is determined by story first—but it’s more complicated. A story in our view is invariably connected with all of the circumstances and imperatives that contribute to the emergence of a growth company.

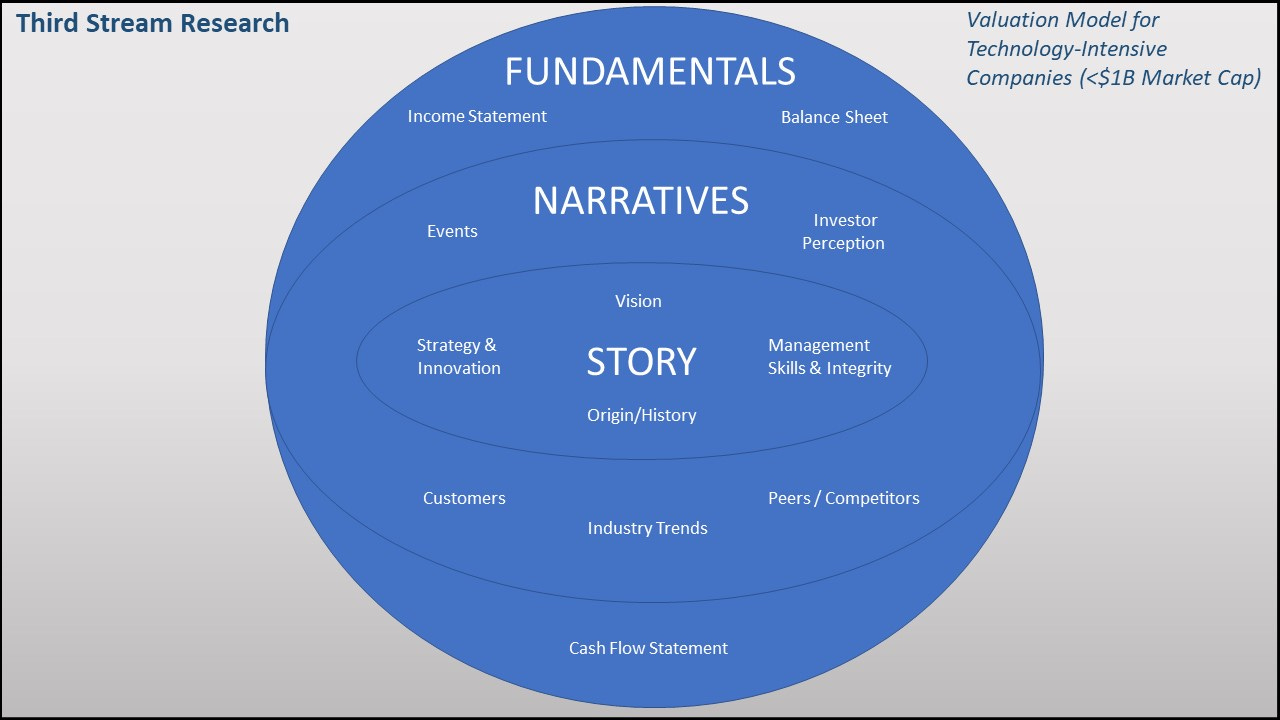

Our valuation model for technology-intensive companies with market capitalizations up to $1 billion is illustrated below. Models are always abstract and simplifications of the real world, so the sphere conveys the three main concepts—Story, Narratives, and Fundamentals with their main elements—and alludes to the myriad relationships across all levels:

STORY: the essential qualities of a company

NARRATIVES: of or relating to the process and development of a company’s story

FUNDAMENTALS: metrics and methods of measuring a company’s intrinsic value

Third Stream Research modifies the widely accepted definitions of Story and Narratives to help describe how we research and analyze Adventure Companies, which eschews financial models to predict the future.

Formalizing a methodology is a worthy effort that we continuously strive to attain. Progress comes in fits and starts, but each step moves us closer to understanding how the diverse, complex, and dynamic elements work together to form a clear picture of a company with insight into probabilities about future paths.